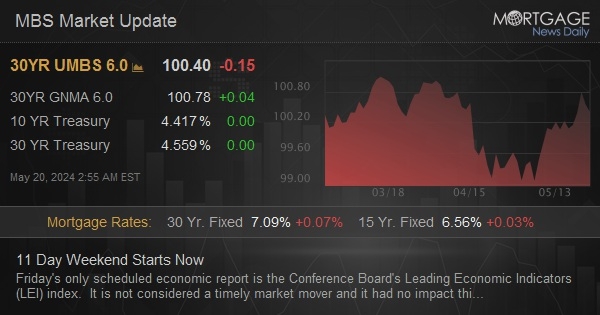

Friday’s only scheduled economic report is the Conference Board’s Leading Economic Indicators (LEI) index. It is not considered a timely market mover and it had no impact this morning despite coming in at -0.6 vs -0.3 forecast. The slate of scheduled data isn’t much better next week. The only report with a track record of significance is the S&P PMIs on Thursday, but just the “flash” version (the “final” numbers come out the same week as ISM PMIs in early June). That means next week is nothing but Fed-speak, and since the Fed has had nothing new to say for months, that means next week is nothing. Combine it with the official 3.5 day Memorial day weekend, and another 3 days (today + this weekend) and bonds have an unofficial 11 day weekend.

But what does an 11 day weekend actually mean in this context? After all, it’s not as if the bond market will actually be closed next week. We’re also not suggesting a complete absence of bond market movement. While we may be a bit jaded on predictable Fed speeches, an anxious market could still jump to conclusions if certain Fed speakers make comments that have a direct bearing on potential changes in June’s dot plot (the summary of Fed members’ projections for the Fed Funds Rate).

To underscore the absence of excitement surrounding the Fed’s outlook right now (and the reason we don’t really care about an extremely active slate of Fed speakers next week), consider the following chart which overlays Fed Funds Rate expectations with longer term bond yields. Here in the mortgage market, we pay more attention to longer term yields and there’s been a good amount of movement there over the past 2 weeks. But the Fed outlook hasn’t changed much since the April 10th CPI data (small pop on PCE data at the end of April and a small recovery in the first week of May).

Source link

#Day #Weekend #Starts