Financial inequality is a persistent issue in our society, with the gap between the rich and the poor continually widening. While many factors contribute to this disparity, there are several key reasons why the poor often remain trapped in poverty, and the middle class struggles to achieve significant wealth.

In this article, we’ll explore six of these reasons in depth, shedding light on the barriers that prevent financial growth and the steps that can be taken to overcome them.

Why Do the Poor Stay Poor and the Middle-Class Stay Middle Class?

Here are six reasons why the poor may stay poor and why the middle class might not become wealthy:

- Lack of Financial Literacy:

- Poor: Often, people with low incomes have limited access to education about personal finance, budgeting, and investing, leading to poor financial decisions.

- Middle Class: While they might have basic financial literacy, they may not have the advanced knowledge needed for wealth-building strategies like investing in the stock market and real estate, building a business, or understanding tax advantages.

- Limited Access to Capital:

- Poor: Without access to credit or capital, low-income people often can’t invest in opportunities to improve their financial situation, such as education, buying stocks, starting a business, or purchasing a home.

- Middle Class: The middle class might have some access to credit but often lack the significant capital needed for high-return investments like real estate or to start larger-scale businesses.

- High Cost of Living:

- Poor: Most of their income goes towards necessities like housing and food, leaving little to no room for savings or investments.

- Middle Class: They might also face high housing, education, and lifestyle inflation costs, which can prevent substantial savings and investment.

- Job Market and Wage Stagnation:

- Poor: Often work low-wage jobs with little job security, limited benefits, and few opportunities for advancement.

- Middle Class: Even with better-paying jobs, wage growth may not keep up with inflation and the rising cost of living, limiting their ability to save and invest.

- Debt and Poor Financial Management:

- Poor: They may rely on short-term high-interest loans to make ends meet, leading to a cycle of debt that is hard to break.

- Middle Class: They might have significant debt from mortgages, student loans, or credit cards, which can consume a large portion of their income and hinder wealth accumulation.

- Mindset and Risk Aversion:

- Poor: They may have a scarcity mindset, focusing on immediate needs rather than long-term goals. They may also avoid taking risks because they fear losing what little they have.

- Middle Class: The middle class often prioritizes job security and may avoid taking financial risks that could lead to significant wealth, such as investing in stocks, starting a business, or investing in real estate.

Addressing these issues requires mindset changes, pursuing financial education, pursuing opportunities for wealth-building for the middle class, and learning how to increase income for the lower socioeconomic classes.

Keep reading for a deeper look at these traps and how to escape them to climb to the next level of prosperity.

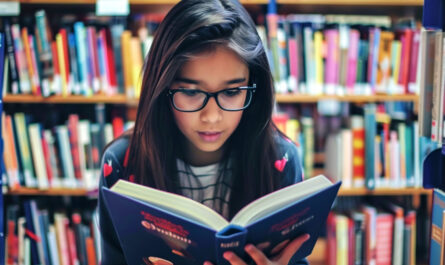

1. Financial Illiteracy: The Barrier to Building Wealth

A lack of financial education is one of the most significant obstacles to building wealth for the poor and middle class. Many individuals in these socioeconomic groups aren’t aware of the best resources that teach personal finance, budgeting, and investing.

This lack of knowledge often leads to poor financial decisions, such as overspending, failing to save for emergencies, and not investing in wealth-building assets. Without a solid foundation in financial literacy, it becomes challenging to break the cycle of poverty and achieve long-term economic stability.

To address this issue, it’s crucial to prioritize financial education at all levels, from elementary school through adulthood. Schools should incorporate personal finance courses into their curricula, and community organizations should offer workshops and seminars on budgeting, saving, and investing.

By empowering individuals with the knowledge and skills to make informed financial decisions, we can help them build a stronger economic future. Everyone must personally pursue a financial education if they ever hope to escape the economic level at which they are currently trapped. Information has never been more accessible and available for free than it is right now online.

2. Limited Access to Capital: The Struggle to Invest and Grow

Another significant hurdle for the poor and middle class is limited access to capital. Without sufficient funds or credit, investing in wealth-building opportunities such as education, real estate, or starting a business becomes difficult.

Banks and other financial institutions often have strict lending criteria that can exclude those with lower incomes or less-than-perfect credit histories. This lack of access to capital perpetuates the poverty cycle and hinders long-term economic growth for people at all economic levels.

To combat this issue, programs and initiatives must be developed that provide access to affordable credit and capital for those who need it most. Microfinance institutions, community development financial institutions (CDFIs), and credit unions can play crucial roles in bridging the gap between the poor and middle class and the resources they need to invest in their future.

By expanding access to capital, we can help level the playing field and give more individuals the opportunity to build wealth. Everyone must take responsibility for how they spend their money and manage their credit history.

3. The High Cost of Living: A Constant Obstacle to Savings

For many in the poor and middle class, a significant portion of their income covers necessities such as housing, food, and healthcare. This leaves little room for savings and investments, making it challenging to build a financial safety net or accumulate wealth over time.

As the cost of living continues to rise, it becomes increasingly difficult for these individuals to keep up, let alone get ahead. To address this issue, it’s essential to focus on strategies that can help reduce your cost of living and allow you to increase savings.

This may include seeking affordable housing options and cutting back on non-essential expenses. Employers can also play a role by offering benefits such as a living wage, health insurance, retirement plans, and financial wellness programs to help ease the burden of high living costs.

4. Job Market and Wage Stagnation: The Uphill Battle for Financial Growth

The job market poses significant challenges for the poor and middle class, with many individuals stuck in low-wage jobs with limited benefits and opportunities for advancement.

Even those with higher-paying jobs may struggle to keep up with inflation and the rising cost of living due to wage stagnation. This makes it difficult to save and invest for the future, further widening the wealth gap.

To combat this issue, it’s essential to seek employers that pay fair wages, provide job security, and have opportunities for career growth. This may include communities investing in education and job training programs to help individuals acquire the skills they need to advance in their careers.

Attracting and rewarding employers and businesses can improve the job market and help the poor and middle class achieve financial stability and growth.

5. Debt and Poor Financial Management: The Vicious Cycle of Financial Strain

Debt is a significant obstacle to wealth accumulation for the poor and middle class. Many individuals in these groups rely on high-interest loans, such as payday or credit card debt, to make ends meet.

This can lead to a vicious cycle of debt that is difficult to break, as the high interest rates and fees associated with these loans can quickly spiral out of control.

Promoting financial education and access to affordable credit options is essential to address this issue. This may include expanding access to credit unions and CDFIs and offering financial counseling and debt management services.

Helping individuals manage their debt and make informed financial decisions can allow them to break the cycle of economic strain and build a more stable economic future.

6. Mindset and Risk Aversion: The Psychological Barriers to Wealth Accumulation

Finally, mindset and risk aversion can be significant barriers to wealth accumulation for the poor and middle class. Those living in poverty often develop a scarcity mindset, focusing on immediate needs rather than long-term goals.

This can make it challenging to prioritize saving and investing for the future. Similarly, the middle class may prioritize job security over taking financial risks, such as starting a business or investing in the stock market, which can limit their potential for wealth creation.

To overcome these psychological barriers, it’s essential to cultivate a growth mindset and embrace calculated risk-taking. This may involve seeking out mentors and role models who have successfully built wealth and educating oneself on the potential rewards and risks associated with different investment opportunities.

By shifting one’s mindset and being open to new possibilities, individuals can break free from the limitations of their socioeconomic background and achieve greater financial success.

Conclusion

Breaking the cycle of poverty and achieving financial success is no easy feat, but by understanding the barriers that hold people back, steps can be taken to overcome them. The poor and middle class can build a more stable and prosperous future with financial literacy, access to capital, managing the cost of living, fair wages, and job opportunities, debt management, and cultivating a growth mindset.

It’s time for everyone to take individual responsibility for how they think, spend, learn, and manage their finances. It’s crucial to pursue better opportunities to improve your current financial situation.

#Reasons #Poor #Stay #Poor #Middle #Class #Doesnt #Wealthy