For the most part, the current week is sorely lacking in the sort of scheduled economic data and events that typically contribute to exciting movement in the interest rate world. This morning’s report on the services sector offered one of the only potential exceptions. For those looking for at least a little excitement, the data did not disappoint. For those hoping that excitement would be positive, it’s a different story.

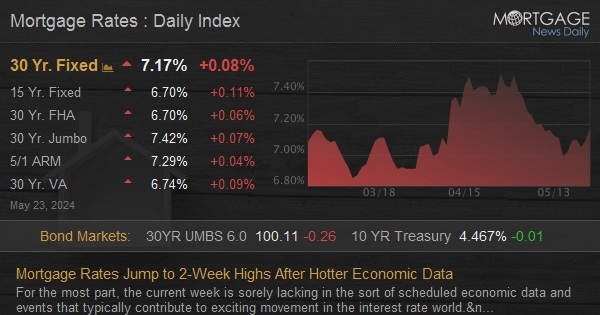

S&P Global’s service sector PMI rose to the highest levels in exactly a year, and that effectively matched the highest level in more than 2 years. Underlying details showed the highest prices in 18 months. None of the above was good news for interest rates. Traders immediately sent bond yields higher.

Mortgage lenders base their rates on trading levels in the bond market. The average lender hadn’t yet published rates for the day when the S&P data came out. Those lenders simply began the day at noticeably higher rates about an hour later. Several lenders had already released rates before the data. Most of that group ended up “repricing” to higher levels not too long after the economic data.

In the big picture, 2-week highs for mortgage rates don’t mean much. The range has been fairly narrow over that time. We’ll have to wait for the first half of June for the most important data and events. That’s when the real excitement is most likely to play out, for better or worse.

Source link

#Mortgage #Rates #Jump #2Week #Highs #Hotter #Economic #Data