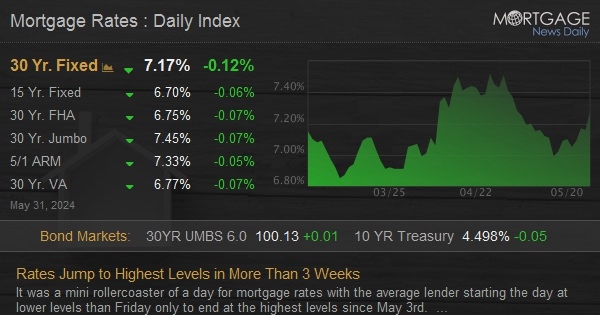

It was a mini rollercoaster of a day for mortgage rates with the average lender starting the day at lower levels than Friday only to end at the highest levels since May 3rd. The weakness was driven by a combination of economic data, comments from Fed officials, and weaker US Treasury auctions.

There are several small consolations. First off, last week’s rates were already in line with 2 week highs. More importantly, the recent range is fairly narrow, meaning it didn’t take much of a jump in the bigger picture in order to see 3-week highs.

The average lender is at least an eighth of a percent higher than they were for the equivalent scenario on Friday morning with top tier conventional 30yr fixed quotes in the 7.25% neighborhood

Source link

#Rates #Jump #Highest #Levels #Weeks